Letter from the Executive Management

Fiscal Year 2013 Returns

The Permanent University Fund (the "PUF") and the General Endowment Fund (the "GEF") � together the "Endowments" � had investment gains of 8.8% and 9.0%, respectively, for the fiscal year ended August 31, 2013 ("2013"). While the PUF and the GEF have similar investment strategies and implementations, oil and gas revenues going into the PUF caused its returns to slightly trail the GEF due to the time-lag associated with putting that cash to work.

PUF assets totaled $14.9 billion and GEF assets totaled $7.4 billion at fiscal year-end. This represents all-time peaks for the Endowments. Combined with the other funds managed by UTIMCO, namely the Intermediate Term Fund, and the Short Term and Debt Proceeds Funds, UTIMCO's assets under management totaled $30 billion, also an all-time peak.

The Endowments' actual returns exceeded the Policy Portfolio Benchmark by 1.3% for the PUF and 1.5% for the GEF. As a reminder, the Policy Portfolio Benchmark represents the returns that would result without UTIMCO staff, or said precisely, the investment returns that would be realized if each asset class was at its Policy Portfolio target weight and generated that asset class' average returns.

Over the past five years, the Endowments actual returns have outperformed the Policy Portfolio Benchmark by an average of 2.1% per year, resulting in $428 million per year of additional resources for the UT and A&M Systems. In 2013 alone, $286 million of additional resources was generated.

UTIMCO analyzes other top endowments in order to identify "best practices". Over the last few years, the Endowments' investment returns have lagged other large endowments primarily due to the Endowments' lower risk profile. The Endowments' risk-adjusted returns are in the middle of the pack. UTIMCO staff, the UTIMCO Board ("Board") and The University of Texas System Board of Regents (the "Regents") have all concurred with having a less-risky portfolio, particularly given global economic uncertainties. While it is the case that risk has been rewarded over the past few years, there is agreement that the necessity to protect principal supersedes the desire for higher investment returns.

Investment Strategy

Readers of previous Annual Report letters may observe that this part of the annual letter has remained � and will remain again this year � consistent. That is because as a long-term investor our investment strategy remains relatively constant, while our implementation is flexible in order to capitalize on capital market opportunities.

Our core investment principles, and therefore strategy, include beliefs that:

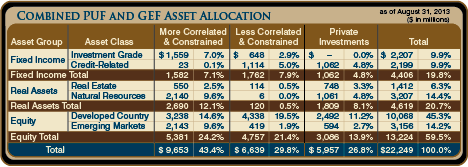

- A diversified portfolio produces the best risk-adjusted returns. Therefore, we invest across all asset classes, capital structures, investment styles and geographies. One method of diversification is across investment styles, as manifest in our More Correlated and Constrained ("MCC", or long-only), Less Correlated and Constrained ("LCC" or hedge fund) and Private Investment exposures.

- Skill matters when investing. Therefore we continue to partner with the best investment managers around the globe. In fact, staff spends the majority of its time identifying, diligencing, structuring and monitoring external investment managers.

- A bias toward value is prudent, providing a margin of safety.

- Capital markets are subject to the same supply and demand imbalances at various times as other markets. Therefore, we look to take advantage of favorable imbalances in our investment decisions. For example, across many developed countries, particularly in Europe, capital demand exceeds capital supply in many assets classes, including real estate, where the bifurcation between core and non-core pricing is at historic highs.

- Emerging markets will continue to grow in the long term, albeit likely at lower rates than experienced over the past few decades. While economic growth creates demand for capital, we base our decision to provide capital on current asset pricing and expected returns. Emerging market investments present additional risks such as political and currency uncertainties, for which we must believe we will be compensated.

- Equity will outperform fixed income over the long term. Therefore we have an "equity orientation". We also recognize, however, that during certain periods fixed income can present attractive risk-adjusted returns. We also retain a certain fixed income "cushion" to ensure liquidity to meet distribution and other short-term obligations.

- Real assets � real estate and natural resources � present attractive investment opportunities in an environment of monetary ease, as well as a "third leg" of diversification with stock and bonds. Attractive returns may be generated in real estate given the large amount of debt used to acquire assets, and in natural resources given the long-term demand dynamics and the capital intensive nature of the value-add supply chain.

- As an "in-perpetuity" investor our long-term horizon enables us to prudently assume reasonable levels of illiquidity risk. We are mindful of the uncertainty of being rewarded for expending illiquidity risk, so we work to be thoughtful and deliberate in our private commitments.

Every year we engage in a thorough review of our Investment Policies ("Policy") with our Board and the Regents. This year we updated our five year investment strategy plan to continue increasing exposure in Real Assets and Private Investments.

Click to print charts in this section using PDF format

Tactical Allocation and Portfolio Positioning

During 2013, although actual investment performance beat the Policy Portfolio by 1.3% in the PUF and 1.5% in the GEF, tactical allocation detracted .9%, or 90 basis points. Tactical allocation refers to staff's positioning of investments in specific asset classes over or under Policy targets, but always within specified ranges.

Given concerns with the global economic environment, the portfolio was slightly under target in Developed Country and Emerging Market Equity. The underweight in Emerging Market equity proved prescient but the underweight in Developed Country equity detracted from performance.

The largest tactical detractor from investment returns in 2013 was the approximately 4% of the portfolio invested in gold. The investment was made a number of years ago and enhanced returns in prior years. The investment was made, and continues, as a hedge against excessive central bank monetary easing. If global growth improves, facilitating central banks removal of liquidity from capital markets, the gold investment may not yield attractive returns, but under this scenario the vast majority of the investment portfolio should produce more than adequate returns.

For the most part, the portfolio is invested close to target and undergoes only modest, incremental changes over the course of the year.

Highlights of the portfolio positioning include:

- Approximately 7% of the portfolio is invested in MCC Investment Grade Fixed Income. This part of the portfolio provides liquidity and diversification.

- The MCC Natural Resources portfolio includes the gold position, with the remainder evenly divided between broad commodity trading strategies and natural resources related public equities. MCC Real Estate brings core real estate exposure to the overall portfolio through investments with REIT investment managers. Each of the broad commodities, natural resources related public equity and REIT positions comprise approximately 2.5% of the overall Endowment portfolio.

- MCC Developed Country Public Equity exposure includes external managers focused on high-quality global companies as well as external managers who invest in mid and small capitalization companies. This exposure represents approximately 15% of the total Endowments.

- MCC Emerging Market Public Equity contains external managers with global, regional or country-specific emerging market investment mandates. These managers typically rely on a broad, disciplined investment approach and/or market-specific, local insight. The Endowment exposure in this portion of the portfolio is approximately 10%

- The LCC book, at 30% of total assets, remains the largest allocation for the Endowments. UTIMCO has a diversified portfolio of approximately forty hedge fund managers employing a variety of investment strategies including long/short equity, event, opportunistic, credit and distressed securities, and global macro approaches. The LCC exposure generates "equity-like" returns with "bond-like" volatility risk. Our LCC external managers use modest levels of leverage, provide substantial position transparency, practice strong risk management and generally approach investing with a value bias based on superior fundamental research.

- UTIMCO's Private Investment portfolio remained at approximately 27% of total assets and spans a broad range of asset classes including illiquid credit, and real estate, natural resources, buy-out, growth and venture capital equity. One measure of the portfolio's success is that in 2013, distributions of $1.5 billion outpaced capital calls of $1.3 billion. During 2013, staff made $1.5 billion of new commitments to 21 external managers.

- Illiquid credit exposure continues to recede as successful investments are monetizing.

- Real estate and natural resources related private equity exposures continue to increase as staff pursues, identifies and partners with talented managers in attractive market opportunities.

- Buy-out and venture capital exposure remains steady as new investment opportunities in the lower middle market and certain venture capital market niches replace monetizations.

- Emerging market growth-oriented private equity again increased at a measured pace as staff continues to prudently seek trusted and skilled partners to invest in this potentially rewarding area

Active Management

Active management refers to the actual returns generated by our external investment managers relative to the average returns in their respective markets. These efforts generated additional returns of 2.2% for the PUF and 2.4% for the GEF in 2013.

In fact, UTIMCO staff focuses the vast majority of its effort on partnering with "best in class" managers in order to deliver this level of value added returns. One set of metrics underscoring this is that staff participated in over 1,075 meeting with prospective investment managers and over 1,350 meetings with existing managers during the year. These meetings are in addition to the materials that were reviewed and analyzed on existing and new investments, as well as the basic market research that is conducted on an ongoing basis.

- The MCC Investment Grade Fixed Income portfolio outperformed its benchmark by 3.1% as the market experienced an average loss of (3.4%) and our portfolio was down (.3%). This level of outperformance is stellar in this area of the capital markets.

- The MCC Real Estate active managers produced a 9.1% return, outperforming their benchmark by 3.2%, a very strong showing.

- The MCC Natural Resources portfolio was down (1.0%) versus a benchmark decline of (3.5%) as our public equity managers substantially outperformed their market averages.

- The MCC Developed Country Public Equity portfolio generated returns of 24.6%, far in excess of the market average 17.6%. Staff has focused on this part of the book over the past few years and is pleased that the results are so positive.

- The MCC Emerging Markets Public Equity portfolio was up 1.3%, also besting its benchmark return of .5%. Staff continues to focus on this portfolio and is pleased with the progress that has been made given that in previous years actual returns have lagged the market average.

- The LCC portfolio posted an 11.5% return, far in excess of the 6.1% average fund of fund benchmark. This portfolio continues to generate top or second decile returns relative to its peers.

- Private Investments generated returns of 13.3%, outpacing the market average return of 13.2%. And given the more conservative nature of our portfolio with such a large portion in less-risky, shorter-lived credit related investments, this outperformance is all the more impressive.

2013 Market Recap and 2014 Outlook

Central banks and centrally planned economies continue to dominate global capital markets, skewing their purely economic functioning.

The United States Federal Reserve talked of tapering, although none has yet transpired, while the federal government lurches from crisis to crisis without a pragmatic, realistic focus on long-term fiscal policy. Japan is easing mightily with uncertain implications, and structural reforms have yet to be adequately enacted. Europe is not dead but may not be fully alive either.

China's new regime is dealing with a legacy of non-market directed over-investments. India is, as usual, navigating volatility not altogether unrelated to the country's volatile governance. Russia remains resource rich and rule of law challenged. Brazil continues to combat inflation while debating the optimal level of government entitlements and redistribution.

Due to the fear of tapering, U.S. and Global Barclay's bond indices were down -2.5% and -3.4%, respectively. Overall, commodities prices fell 10.6%, while spot oil prices rose 11.6%. Fueled with low cost capital, developed country equity markets posted strong gains during the 2013 fiscal year as both the S&P 500 and the EAFE rose 18.7%. Emerging market public equities were flat after being up over 12.5% at mid-year.

Our view for the past few years remains our view for the next few years, summarized in the headline "Long Workout, Long March".

Growth areas exist, even in a Long Workout: U.S. energy and information technology's global transformation are two examples. Certainly austerity is part of the equation, which provides more investment warnings than opportunities. Good assets being sold by stressed sellers at compelling discounts is another example of a Long Workout investment opportunity. Given the public nature of the debt, monetization may also be a dynamic and therefore an investment consideration.

Long Marches are messy and hard and never linear. Growth requires capital, and if it is invested with the right partners in the right structures and at the right prices, then attractive risk-adjusted returns should be earned. Perhaps the biggest single variable in country selection is whether the government has some record of commitment to free capital markets, governed by consistent laws and adjudicated when necessary in independent courts � and will continue to do so into the future.

Importantly, UTIMCO takes a "bottom-up" approach with the objective of "making one good investment at a time". Our comprehensive and consistent engagement with investors across global capital markets helps position us to take advantage of opportunities as they present themselves.

Board and Staff

The Board and staff are the keys to UTIMCO's investment success.

We are grateful for Paul Foster and Printice Gary's service on the UTIMCO Board. Paul Foster's leadership as Chairman was strong, steady, and thoughtful, and we wish him well as he assumes the Chairmanship of the Regents. We welcome Jeff Hildebrand and Robert Stillwell to our Board, and we appreciate Morris Foster agreeing to Chair the Board.

We are grateful for the open communications we have with our colleagues at the UT and A&M Systems and their respective institutions. In addition, we appreciate the oversight, direction and support we receive from the Regents.

We cannot express enough our gratitude to the UTIMCO staff, who has worked together now for a number of years to continuously enhance results. Senior investment staff is fully in place, seasoned, and integrated. Improvements in manager identification, investment structuring, and economic alignment efforts are being implemented. A major project to enhance information technology is underway. We have a great group of people who tirelessly apply their extraordinary skills to increase the resources available to the public institutions we serve. We couldn't ask for a better team to be part of.

We are pleased to have had a positive year of investment returns. We believe we are prepared for whatever the markets may offer, and we are committed to doing our best, each and every day.

|

|

|

|

Bruce Zimmerman

Chief Executive Officer and

Chief Investment Officer

|

|

Cathy Iberg

President and Deputy

Chief Investment Officer

|