Endowments established through private contributions as well as those that are funded by the State of Texas provide critical support for faculty, students and academics - now and in perpetuity. These endowments represent a permanent legacy in support of the highest ideals of our society - educational opportunity, the dignity and worth of the individual, freedom of inquiry, the advancement of knowledge, and the conquering of frontiers.

The margin for excellence in higher education is dependent upon the preservation and enhancement of the endowment assets entrusted to The University of Texas System (UT System) by its donors and the State of Texas. Endowment funds are permanent funds by their nature. That is, endowment funds must provide for the economic needs of today while remaining intact to provide the same level of economic support for future generations, not just the next ten to twenty years, but hundreds of years down the road. This requires quite a balancing act in managing the endowment funds.

Click to print charts in this section using PDF format

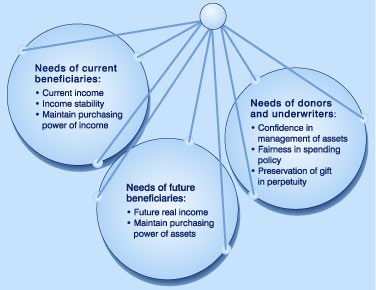

Unfortunately, at some points in time the needs or desires of one group of beneficiaries may directly conflict with those of another group. For example, current beneficiaries might call for current income to be increased to a point that the value of the endowment fund would be negatively impacted and become unable to support the needs of future generations of students.

How is it possible to balance all the competing needs to enable the funds to continue in perpetuity to provide educational and health care support for the benefit of the institutions for which they were created?

The responsibility for balancing the competing needs ultimately rests with The University of Texas System Board of Regents (UT Board). The Texas Constitution and various state statutes have designated the UT Board as the fiduciary for the management of the Permanent University Fund (PUF), the Permanent Health Fund (PHF), and The University of Texas System Long Term Fund (LTF). The UT Board also serves as the fiduciary for institutional operating funds and funds of various trusts and foundations for which it serves as trustee.

The UT Board has appointed The University of Texas Investment Management Company (UTIMCO) as its investment manager with complete authority to act for the UT Board in the investment of the assets entrusted to the UT Board. Created in March 1996, UTIMCO is a 501(c)(3) corporation and is the first external investment corporation formed by a public university. The UT Board appoints the nine-member Board of Directors that governs UTIMCO. The UTIMCO Board of Directors includes three members of the UT Board, the Chancellor of The University of Texas System, and five outside investment professionals. The UTIMCO staff includes specialists in accounting, finance, information technology, and administration as well as experienced and specialized investment professionals.

UTIMCO's mission is to earn returns from the investment of endowment assets which permit two primary objectives:

- Provide for current beneficiaries by increasing the annual distribution at a rate at least equal to the current rate of inflation so that real purchasing power is maintained, and

- Provide for future beneficiaries by increasing the market value of endowment funds after the annual distribution at a rate at least equal to the rate of inflation so that future distributions maintain purchasing power as well.

Of course, these objectives are inherently contradictory because higher annual distribution rates reduce the endowments' ability to grow over time. Ultimately, it is the UT Board which must resolve these conflicts by setting, with recommendations from UTIMCO, investment policies and distribution levels which balance the needs of current beneficiaries, future beneficiaries, and donors.

UTIMCO assists the UT Board in this difficult balancing task by developing intermediate and long term capital market forecasts, recommending asset allocation targets and ranges, setting appropriate risk limits, and by managing the assets of the endowments within the guidelines established by the UT Board. An important element of UTIMCO's work is providing forecasts of how investment returns, inflation, expenses, and payout rates are likely to affect the future purchasing power of the endowment funds. Unfortunately, because of reduced return expectations, the balancing task over the next five to seven years is likely to be especially difficult as indicated in the table below:

Click to print charts in this section using PDF format

As these projections indicate, the margin for maintaining purchasing power in the endowment funds is razor thin over the next five to seven years. Fortunately, the longer term view is more encouraging. While UTIMCO will certainly attempt to increase the purchasing power margin through increased investment returns and cost control, the ability to significantly improve real growth is largely outside UTIMCO's direct control for the reasons indicated in the Investment

Returns, Distributions (Spending), Expenses, and Inflation sections.