Financial Highlights

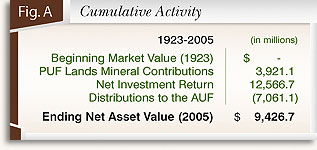

The investment history of the PUF originated in 1923 with the discovery of oil and gas from the legendary Santa Rita No. 1 well. In 1926, the Texas Supreme Court ruled that the proceeds from the sale of mineral production from PUF Lands should be invested as endowment corpus. These proceeds provided the foundation for the PUF Investments to grow to $9.4 billion over the ensuing 82 years, as depicted in Figure A.

Since 1923, a cumulative $7,061.1 million, or approximately 56.2% of cumulative investment return generated on PUF Investments, has been distributed to the AUF in support of the UT System and TAMU System. Over this same time period, the mineral income contributed $3,921.1 million to the PUF investment portfolio.

In more recent times, the PUF has continued to grow as depicted in Figure B. The PUF's net assets have grown from $8,452.3 million to $9,426.7 million, an increase of 11.5% after distributions over the past five years. Fiscal year 2005 resulted in the third consecutive year of strong investment returns, more than offsetting less favorable investment markets in 2001 and 2002.

Click to print charts in this section using PDF format

Click to print charts in this section using PDF format

In addition to strong investment returns during fiscal 2005, the PUF also benefited from the third consecutive year of substantial increases in PUF Lands mineral contributions. Mineral contributions reached $193.0 million in 2005, a 31.6% increase over prior year. Mineral contributions provide a significant and valuable inflow of dollars, leading to a stronger investment portfolio.

The 31.6% increase in mineral income was due to several factors, including $57.7 million of bonuses paid on the sales of oil and gas leases, 30% of total fiscal year mineral income. The PUF also received significant bonuses on the sales of oil and gas leases in the prior fiscal year amounting to $40.4 million.

Royalties on the production of crude oil also contributed to the increase in mineral income over last year, amounting to 41.0% of the total mineral contributions for 2005, and increasing by 34.8% over 2004. Oil prices continued their upward spiral in 2005, with average volume prices realized on oil production increasing by $14.35/bbl to $47.31/bbl. Production volume for the year decreased by approximately 5.57%.

Royalties on the production of natural gas accounted for another 25% of PUF Lands mineral income. Gas prices increased in fiscal year 2005 as well, as average gas prices realized on royalty gas production increased by 19.4% to 5.04/mcf. Gas royalties increased by 10.7%, a result of the increase in wellhead gas prices slightly offset by a net production decrease of 5.79%.

Looking ahead for 2006, we expect mineral income to continue its growing contribution to the PUF. The Energy Information Administration, the official energy forecaster for the U.S. Government, predicts natural gas prices at the Henry Hub to average $9.00/mcf in 2006 and forecasts $64-$65/bbl for West Texas Intermediate Oil.

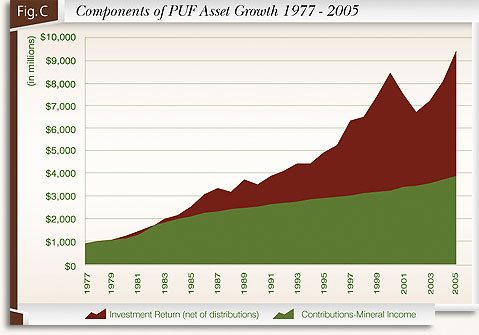

Even with the extremely valuable PUF Lands and the continual inflow of mineral contributions, $1.3 billion credited over the past 15 years alone, preservation of PUF endowment purchasing power is still critically dependent on investment returns, as evidenced by examining the components of growth in the value of PUF Investments since 1977, depicted in Figure C. It is The University of Texas Investment Management Company's (UTIMCO) responsibility to invest the PUF Land contributions and preserve the PUF's purchasing power.

Click to print charts in this section using PDF format

|