Endowment Funds

UTIMCO manages four major endowment funds under the fiduciary care of the UT Board. These four endowment funds, with a combined market value of $14,548.6 million, are the Permanent University Fund (PUF), the Permanent Health Fund (PHF), the Long Term Fund (LTF), and the Separately Invested Funds (SIF). Two of the endowment funds, the PHF and the LTF, are invested in shares of the General Endowment Fund (GEF), an internal mutual fund managed by UTIMCO. The GEF was created to increase efficiencies in managing investments, reduce costs, and streamline reporting.

Representing a permanent legacy, endowment funds provide the means to create a margin of excellence in higher education for UT System's institutions. Since endowment funds are permanent funds by their nature, they must provide for the economic needs of today while remaining intact to provide the same level of economic support for future generations, not just the next ten to twenty years, but hundreds of years in the future. The trade-off between preserving assets for tomorrow and supporting the educational and health care needs of today creates the need for a delicate balancing act in managing the endowment funds.

Balancing the competing needs of current beneficiaries, future beneficiaries and donors is the motivating force behind UTIMCO's efforts to achieve the following two primary objectives:

1. Provide for current beneficiaries by increasing annual distributions at a rate at least equal to the current rate of inflation so that real purchasing power is maintained, and

2. Provide for future beneficiaries by increasing the market value of endowment assets (before adding any current contributions and after deducting current distributions) so that distributions to future beneficiaries will buy the same or better level of goods and services received by today's beneficiaries.

These two primary objectives are inherently contradictory because higher annual distribution rates reduce the endowments' ability to grow over time. Ultimately, the UT Board resolves these conflicts by setting, with recommendations from UTIMCO, investment policies and distribution levels that balance the needs of current beneficiaries, future beneficiaries, and donors.

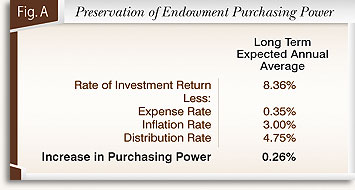

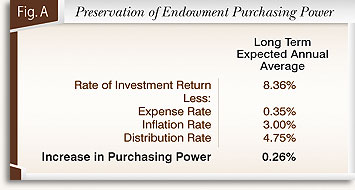

Four factors affect an endowment fund's ability to meet the conflicting needs of current and future beneficiaries. These factors are a) fund investment return, b) fund expenses, c) the rate of inflation, and d) fund distributions. An important element of UTIMCO's work is providing forecasts of how these four factors are likely to affect the future purchasing power of the endowment funds so that the UT Board can make its generational equity balancing decisions.

Investment Returns. Investment returns generated by the endowment funds are determined primarily by the allocation of fund assets to different classes of investments and by the ability of the UTIMCO staff to add value by earning returns greater than those generally available from each asset category. UTIMCO draws on years of investment experience and expertise to determine the best allocations to different categories of assets in order to achieve the returns necessary to meet objectives while protecting endowment assets from severe losses in an adverse market environment. Once allocation decisions are made, UTIMCO focuses on earning the highest returns possible within each asset category while maintaining strict risk control through a quantitative risk budgeting process.

Expenses. UTIMCO incurs expenses associated with analysis, portfolio management, custody and safekeeping, accounting, and other investment related services. Investment fees and other fees paid to external managers are, by far, the largest component of expenses. Fund expenses are paid from fund assets.

UTIMCO's management of $18.3 billion of assets, including operating funds as well as endowment funds, provides for exceptional economies of scale in the management of the investment assets. The ratio of total investment expenses to assets under management was .23% for the year ended August 31, 2005.

Inflation.

Inflation erodes the economic value of an endowment fund by reducing the endowment's purchasing power over time. Since UTIMCO has no control over the rate of inflation, endowment assets must be invested so as to maximize the total return after inflation. The long-term expected rate of inflation is 3.0%.

Endowment Fund Distributions (Spending).

The UT Board determines the annual distributions from the endowments based on UTIMCO's recommendations. The key to preservation of endowment purchasing power over the long-term is control of spending through a target distribution rate. This target rate should not exceed the funds' average annual investment return minus fund expenses and inflation. The UT Board has approved two distinct forms of distribution or spending policies. One is the so-called "constant growth" spending policy, and the other is the "percent of assets" spending policy.

The PHF and LTF utilize the constant growth spending policy. The PHF and LTF distributions are increased annually at the average rate of inflation provided that the distribution rate remains within a range of 3.5% and 5.5% of fund asset value. This distribution policy accommodates current needs without sacrificing the needs of succeeding generations. The constant growth spending policy uses a smoothing formula to reduce annual volatility in spending and to maintain spending on a sustainable basis.

The PUF utilizes the percent of assets spending policy. The PUF's annual distributions are based on a distribution target of 4.75% of the PUF's three-year average net asset value. This policy has been chosen for the PUF because it is best for endowments in which the current distribution is small relative to the total budget, and where long-term growth of the fund is the key objective, which are the characteristics of the PUF and its beneficiaries.

Click to print charts in this section using PDF format

Based on the four factors above, it is obvious that preserving purchasing power is quite difficult and challenging. UTIMCO's fiscal 2005 forecast for these factors are shown in Figure A.

Endowments require investment management in accordance with long-term investment objectives because of the perpetual nature of the funds. Recognizing that the investment environment will only become more challenging in the future, UTIMCO will meet the challenge by maintaining a specialized and experienced investment staff focused on adding value within a well-structured and disciplined asset allocation and risk control process.

Inflation.

|