Expenses

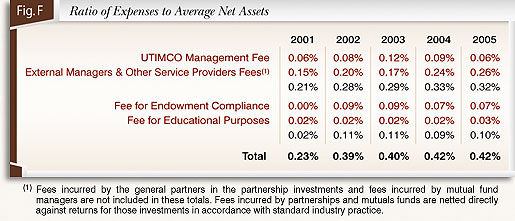

The large asset base under UTIMCO's management allows for economies of scale in management of the endowment funds. The GEF was created as the investment vehicle in which the LTF and PHF could get cost effective exposure to a well diversified investment portfolio. The GEF incurs expenses for external management fees, custody and safekeeping fees, and other fees related to its operations. Both the LTF and PHF pay the same fee for every unit of GEF owned by these funds. However, there are additional expenses which differ for the LTF and PHF. Therefore, the total fee paid by each unit of the LTF includes LTF expenses plus a portion of the GEF expenses. The UTIMCO fee for 2005 fiscal year was .06% of LTF average net assets; fees and expenses paid to external managers and other service providers totaled .26% of LTF average net assets.

The LTF is also assessed an annual administrative fee on behalf of UT System institutions for the support of enhanced endowment compliance. This assessment began in fiscal year 2002. In addition, the LTF is assessed an education fee by UT System. The compliance and education fees for 2005 were .10% of LTF average net assets.

Figure F depicts the LTF's expenses as a percentage of the LTF's net asset value for each of the past five years.

Click to print charts in this section using PDF format

|