Overview

Click to print charts in this section using PDF format

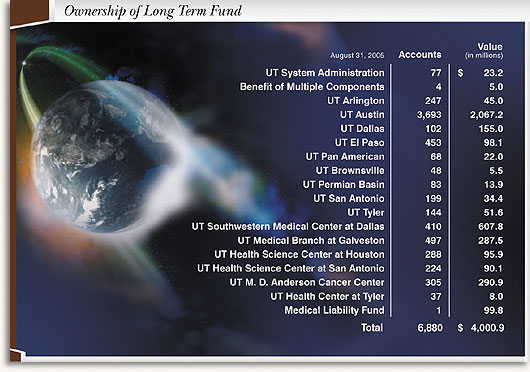

Totaling $4.0 billion, The University of Texas System Long Term Fund (LTF) is an internal UT System mutual fund for the pooled investment of over 6,800 privately raised endowments and other long-term funds of the 15 institutions of the UT System. Most gifts given to fund endowments are commingled in the LTF and tracked with unit accounting much like a large mutual fund. Each endowment or account purchases units at the LTF's market value per unit. Cash distributions are paid quarterly, on a per unit basis, directly to the UT System institution of record. Distributions from the LTF fund scholarships, teaching, research, and medical liability insurance programs across the UT System.

In order to take advantage of lower unit costs, attractive investment opportunities, and broader diversification benefits available from a larger investment fund, the endowment assets in the LTF are invested in The University of Texas System General Endowment Fund (GEF), a broadly diversified mutual fund created by the UT Board of Regents in March, 2001, which is managed by The University of Texas Investment Management Company (UTIMCO). The LTF currently owns 81.2% of the GEF's $4.9 billion net asset value. LTF contributions are invested in the GEF on a quarterly basis. These contributions purchase additional GEF units at the prevailing market value price per unit. The other GEF unit holder is the Permanent Health Fund (PHF).

|